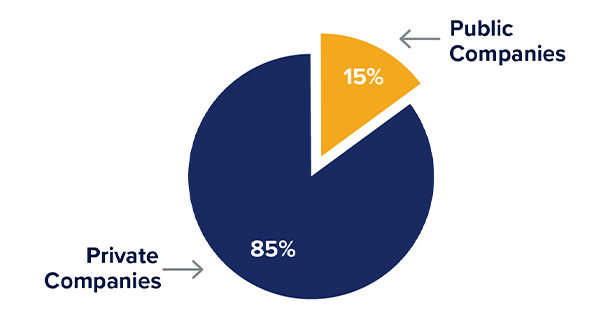

When companies stay private, they don’t have to report to shareholders or divulge their strategies or finances. That may be why the number of U.S. public companies has fallen by nearly 50% since the 1990s.1 With more than 85% of U.S. companies with revenues over $100 million being private, many of the best growth opportunities are inaccessible to the vast majority of individual investors.

Understanding the Private Markets

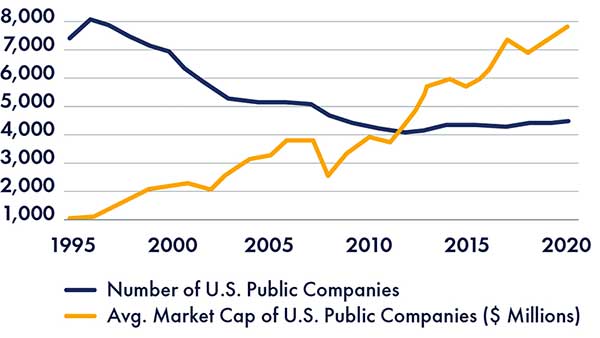

NUMBER & SIZE OF PUBLIC COMPANIES

50% reduction in the number and 8x increase in the size of public companies over the last 25 years.1

LESS THAN 15% OF COMPANIES WITH REVENUE OVER $100 MILLION ARE PUBLICLY HELD

The number of public companies has been declining, leaving investors unable to access a significant portion of the U.S. economy.2

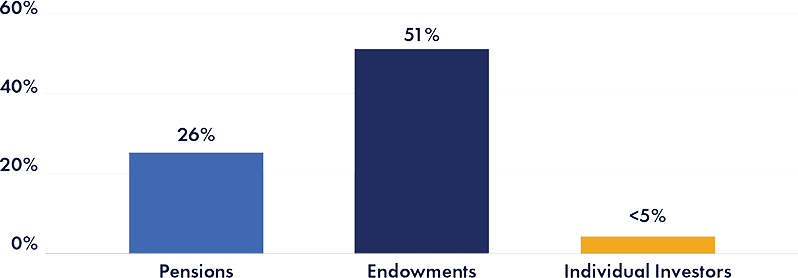

INSTITUTIONAL DEMAND

Family offices and institutional investors such as pensions, foundations, and endowments, have long recognized the benefits of investing in private markets, such as the potential for enhanced returns, income generation, lower correlation, and diversification.3 Allocations to private equity of 15% to 40% or more are common among these large, sophisticated investors.

ALTERNATIVE ALLOCATION: INSTITUTIONS VS INDIVIDUALS4

In 2021, private equity invested over $1 trillion in companies across America, spanning every sector, including healthcare, energy, information technology, materials & resources, hospitality and many more.6

America’s Middle Market – An Untapped Powerhouse

America’s middle market companies – those typically viewed as having annual revenues between $10 million and $1 billion – make up more than 30% of the U.S. economy, but because most are privately owned, individual investors may miss out on opportunities to invest.5

- Middle market businesses account for about one-third of the U.S. economy.5

- Approximately 48 million Americans are employed by middle market companies.5

- There are nearly 200,000 middle-market firms in the U.S. and most tend to be privately owned or closely held.5

Could Private Equity Become as Popular as Public Equity?

Expanding access to private markets allows individuals to consider opportunities currently outside their reach and may result in better portfolio outcomes. With education about the risks and considerations of investing in private markets, coupled with the increased availability of high-quality investment opportunities, we believe private equity could become as commonplace in investor portfolios as public stocks and bonds.

1. Kumar, Sandeep. “Why are High-Growth Companies Staying Private for Longer?” October 19, 2021. https://medium.com/torre-capital/why-are-high-growth-companies-staying-private-for-longer-126486a26e9b

2. S&P Capital IQ data as of December 2022; Statistics of U.S. businesses; Bain & Company, Global Private Equity Report, February 27, 2023

3. INVESTCORP, Increasing Allocation to Private Markets, June 2021

4. Willis Towers Watson. “Global Pension Assets Study.” 2021. National Association of College and University Business Officers. “TIAA Study of Endowments.” 2021. Cerrulli. “U.S. Intermediary Distribution 2020.” 2020. For endowments, the alternative asset allocation is for the public college, university or system only and represented by allocations to other equities (includes marketable alternatives, private equity and venture capital) and real assets (includes TIPS, REITs, commodities/futures, publicly traded master limited partnerships (MLPs), public traded natural resource equities, private energy and mining and private agriculture and timber). Averages provided are dollar-weighted. For individuals, the alternative asset allocation includes “alternatives” (e.g., long/short, market neutral, currency) and “other” as defined as UITs, listed and unlisted closed-ended funds and private funds. Responses are weighted based on the average asset allocation of a moderate client.

5. Year-End 2022 Middle Market Indicator. National Center for the Middle Market. 2023.

6. American Investment Council. https://www.investmentcouncil.org/

There is no assurance that you will be able to tender your shares when or in the amount that you desire. Although the Fund will offer quarterly liquidity through a quarterly repurchase process, an investor may not be able to sell or otherwise liquidate all their shares tendered during a quarterly repurchase offer.

The Shares are speculative and illiquid securities involving substantial risk of loss. An investment in the Fund is appropriate only for those investors who do not require a liquid investment, for whom an investment in the Fund does not constitute a complete investment program, and who fully understand and are capable of assuming the risks of an investment in the Fund.

Before investing, carefully read the prospectus here.

Distributor: Foreside Financial Services, LLC.